Contents

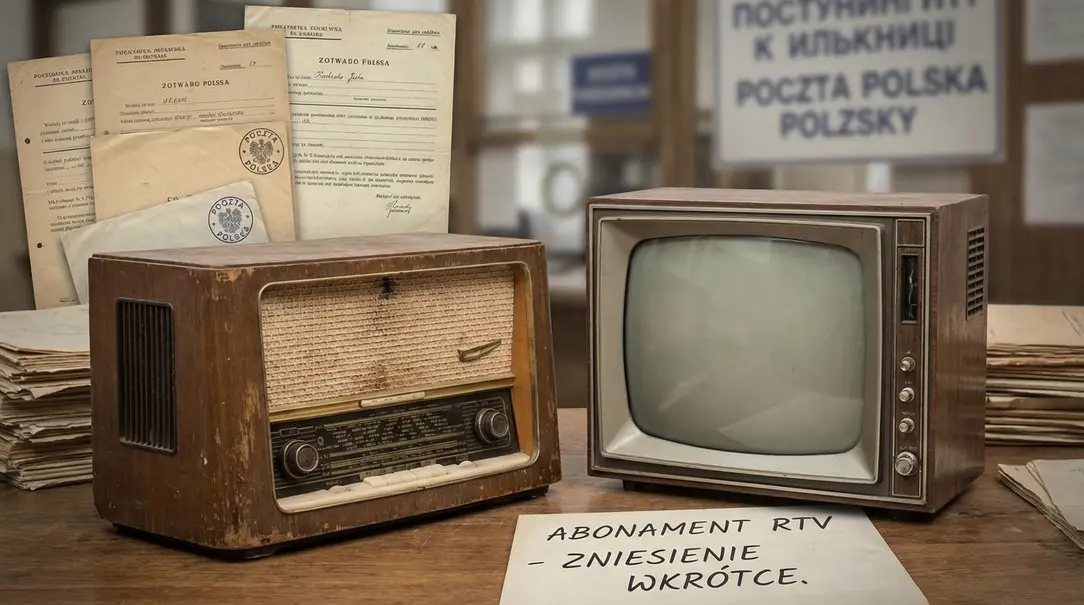

RTV Broadcast Fees in Poland: Expanded Exemptions and Upcoming Abolition (2026-2027)

Significant changes are underway regarding RTV (Radio and Television) broadcast fees in Poland. As of early February 2026, more residents will be eligible for exemption from these mandatory public broadcasting charges. This news comes just as the country prepares for the complete abolition of RTV fees by January 1, 2027.

Below, we outline the new conditions for exemption and explain how these fees are set to become a thing of the past.

Who Qualifies for RTV Fee Exemption in 2026?

The increase in average national salaries has directly impacted the eligibility criteria for RTV fee exemptions. The Central Statistical Office (GUS) announced on February 9, 2026, that the average monthly earnings in Poland for 2025 reached approximately $2,225 (8903.56 PLN). Consequently, the maximum pension income threshold for RTV fee exemption has also increased.

As of 2026, individuals receiving a monthly pension of approximately $1,110 (4451.78 PLN) or less are now eligible for a full exemption from RTV broadcast fees. This expansion means a larger segment of the population can benefit from not having to pay these charges.

How to Apply for an Exemption

While the expanded eligibility is welcome news, the exemption is not automatic. To claim your free RTV subscription, you must take the following steps:

- Visit any post office branch.

- Present your identification document (e.g., national ID card).

- Provide official documentation confirming your monthly pension amount.

- Submit a declaration affirming your entitlement to the exemption.

Important Note: If you are aged 75 or older, you are automatically exempt and are not required to submit any additional documents or declarations. This applies nationwide.

Current RTV Fees for 2026

For those not eligible for an exemption, RTV fees remain in effect for 2026. These fees are charged for the ownership of radio and television receivers and contribute to the funding of public broadcasting. The monthly rates for 2026 are:

- Approximately $2.40 (9.50 PLN) for a radio receiver.

- Approximately $7.60 (30.50 PLN) for a radio and television receiver combined.

These fees apply until the end of 2026 for all non-exempt households.

The End of RTV Fees: A Historic Change

In a significant legislative move, the RTV broadcast fees in Poland are set to become a thing of the past. According to a draft of a new media law, the obligation to pay these charges will be abolished on January 1, 2027, with no transitional period.

This means that 2026 will be the final year in which owners of RTV receivers will be formally required to pay the fees. The new regulations concerning the funding model for public media are expected to take effect on the same day the RTV subscription is eliminated.

This development marks a substantial shift in how public broadcasting in Poland will be financed, moving away from a direct household levy.

Frequently Asked Questions (FAQ)

What are RTV broadcast fees?

RTV broadcast fees are mandatory charges in many countries, including Poland until recently, that fund public radio and television broadcasters. They are typically collected from households that own radio or television receivers.

Why are more people exempt in 2026?

The eligibility for exemption in Poland is tied to pension income. Due to an increase in the average national salary in 2025, the corresponding pension threshold for exemption has also risen, allowing more retirees with lower incomes to qualify for free RTV subscriptions.

Do I need to do anything if I am 75 or older?

No, if you are 75 years of age or older, you are automatically exempt from RTV fees and do not need to submit any documents or declarations.

When will RTV fees be completely abolished in Poland?

According to current legislative plans, RTV broadcast fees are scheduled to be entirely abolished on January 1, 2027, with 2026 being the last year for payments.